Join this informational webinar on Monday, January 25th at 2 PM (EST) to learn about the second round of Payroll Protection Program, the Employee Retention Credit, and how these could affect your business. This complimentary webinar will also include a live Q&A session to discuss your queries with Glass Jacobson tax experts.

Some of the topics that will be covered include:

• PPP round 2 overview

• The major changes between PPP round 1 and 2

• What remains the same between PPP round 1 and 2

• Revised eligibility for your business

• Additional eligible expenses - how they may affect you

• Employee Retention Credit

• How to claim the Employee Retention Credit

• How to determine which expenses to be submitted for PPP forgiveness and ERC

• Interactive Question & Answer session

• Next steps

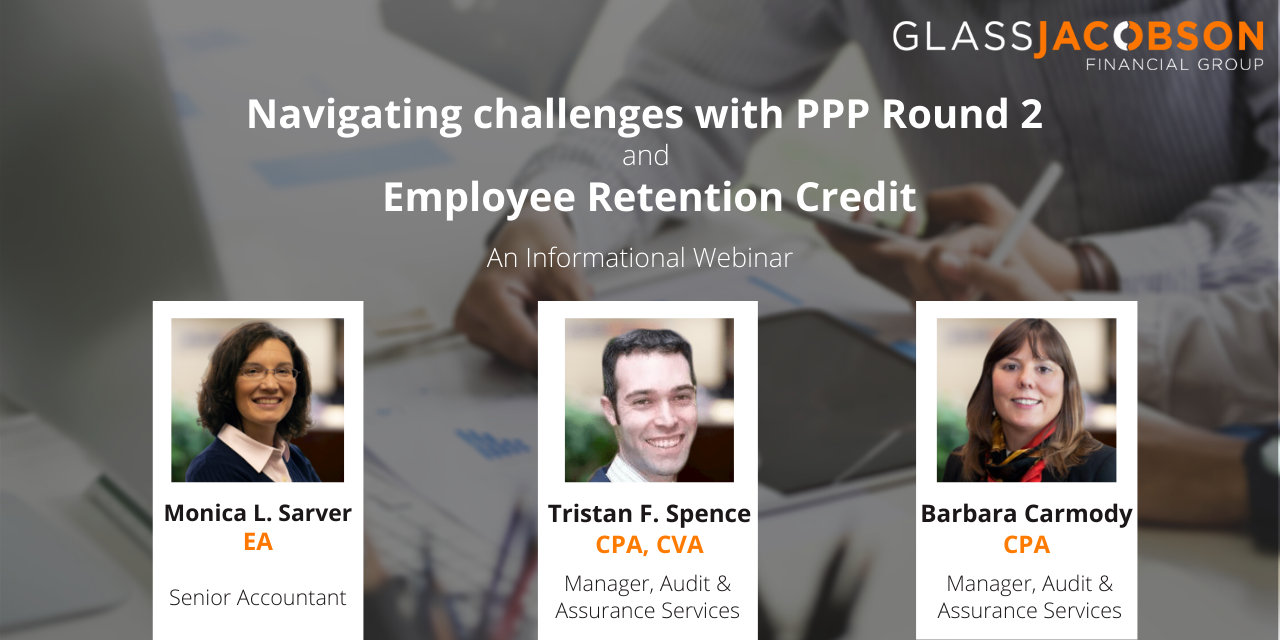

Informational Webinar Presenters:

Senior Accountant

Manager, Audit and Assurance Services

Manager, Audit and Assurance Services Manager, Audit & Assurance Services

Manager, Audit & Assurance Services

Seats are limited to this webinar. Due to high demand, we encourage you to register early to secure your spot.

Comments 2

Will there a recording after?

Author

Hi Kathleen, thank you for your interest in this event. Yes, we will have the webinar recording posted soon.