Savings for a child’s college education just got a little easier with a Maryland 529 plan. Thanks to a new government program, it’s now possible to receive dollar-for-dollar matching contributions (or even better in some cases) to a Maryland College Investment Plan (MCIP), more formally known as the Maryland Senator Edward J. Kasemeyer College Investment Plan.

The Maryland 529 Matching Requirements

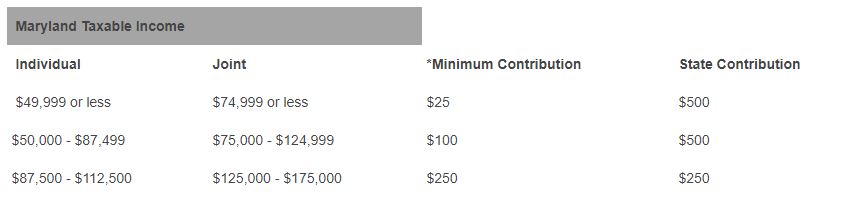

Under the new arrangement, the state government will contribute either $250 or $500 to an eligible MCIP. To qualify, you must have opened an account on or after January 1st, 2017. Your account’s beneficiary must be a Maryland resident, and as the account holder, you cannot earn more than $112,500 per year (or $175,000 for married couples).

Your application for the free cash must be submitted to the Save4College State Contribution Program by 11:59 pm on May 31st of this year (2020). If you miss the deadline, you can still open an account to receive next year’s state contribution.

To be eligible to receive the state’s matching contribution for 2020, your own contribution must be made by November 1st. Beginning in 2020, the state of Maryland now permits automatic monthly contributions in lieu of a one-time contribution.

The State Contribution

For individuals making between $87,000-112,500 (or $125,000-175,000 for married couples filing jointly), Maryland will match a $250 contribution with its own $250 contribution.

It gets better for lower tax brackets. For married couples earning $75,000-124,999, the government will deposit $500 for your $100 contribution. And couples earning less than $75,000 get $500 of free money when they deposit just $25.

Qualified applicants will receive the state’s matching contribution by December 31st of the year in which the contribution was made.

The Caveat

Be aware: Funding for this generous program is limited, and this means it’s possible that some applicants will fail to receive matching contributions. So, it’s a really good idea to get your application in as quickly as possible. If program reserves are exhausted, state contributions will be allocated on a first come, first served basis. The government will also prioritize account holders who didn’t receive a state contribution in the past.

Maryland 529 Tax Deduction & Benefits

Maryland actually has two 529 plans. The second is the Prepaid College Trust. As the name suggests, this account allows parents to lock in future tuition at today’s prices. This one doesn’t come with government contributions, but like the MCIP, it provides a generous deduction on Maryland’s state tax return. The maximum deduction per year per account is $2,500 for both the MCIP and the Prepaid Trust. A great feature of both 529 plans is that excess contributions can be carried over to future tax years.

Earnings in the MCIP and the College Trust grow tax-deferred at both the federal and state levels. Contributions are made with after-tax dollars at the federal level. As long as funds are used for qualified higher education expenses, withdrawals incur no penalties or taxes at the federal level. Earnings have the same policy at the state level.

How to Maximize the State Contribution

A big perk that Maryland offers families is the ability to open multiple 529 accounts and capture the $2,500 state tax deduction for each account every year. For example, a married couple with two children could open four 529 plans. One spouse would be the account holder for a Prepaid College Trust for each of their children. The second spouse would do the same with the MCIP. This arrangement would produce $10,000 in total state tax deductions, assuming each account was funded with $2,500 for the year. The deadline for making contributions for tax purposes is December 31st.

Gifting an MD 529 Contribution

If you are a grandparent, family member, or friend, consider gifting a 529 contribution. Even with the Maryland 529 contribution programs, the ability for parents to meet their college savings goals can seem out of reach. Maryland provides an easy way to give with their GoTuitionSM Gifting Portal.

Further Assistance

If you would like further assistance or advice on educational planning, click the button below to schedule a free consultation with one of our financial planners. If you need help considering the tax consequences of your 529 plan contribution, please contact one of tax CPAs.

Comments 3

Well, it is amazing news that saving money for girl child education has become quite easier in Maryland. The state government has taken a very big step in favor of parents.

Pingback: Maryland 529 plan: Benefits of Contributing to an MD 529 Plan | Afro

Pingback: Maryland 529 plan: Benefits of Contributing to an MD 529 Plan — blackoute