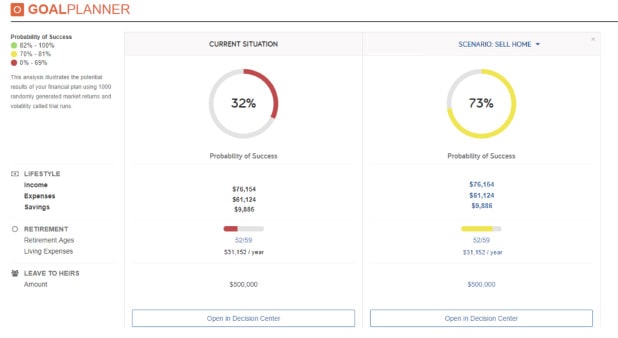

During a divorce, financial decisions will affect your client for the rest of her life. Her divorce settlement scenario seems sufficient because the analysis shows a positive cash flow and positive portfolio assets through retirement. However, when stress tested, you expand your analysis and find there is only a 32% chance of success.

The Downside of Straight-Line Assumptions

Most attorneys and CDFAs only use straight-line assumptions. Straight-Line divorce financial planning assumes a constant growth rate compounded on an annual basis. This does not take market fluctuations into consideration. The probability of returning 6% five years in a row is very unlikely.

Something like this is more likely to occur:

Year 1: 8%

Year 2: -10%

Year 3: 3%

Year 4: 19%

Year 5: 10%

The example above results in a 6% average, but there is fluctuation from year to year.

The timing of the fluctuations could have a significant impact on whether your client will be financially secure. For example, if the market has a significant drop the year before your client retires, it could mean they run out of money. This might be avoided if this scenario is taken into consideration.

What is Stress Testing in a Divorce Settlement?

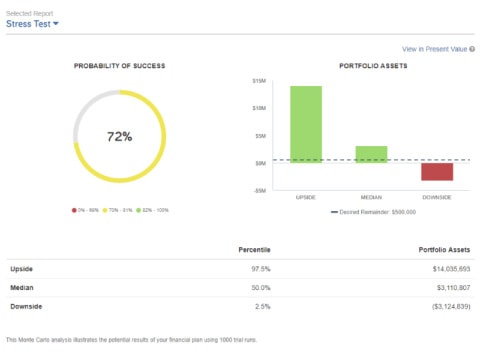

A stress test is simply running your assumptions through a high number of scenarios to come up with a probability of success.

One common type of stress test is the Monte Carlo simulation. This simulation will put your assumptions through a thousand different possible market scenarios. By using historical data collected over changing market conditions, the Monte Carlo simulation shows the likelihood of the proposed settlement’s success or failure.

Benefits of Stress Testing Your Divorce Settlements

Deeper Analysis

Simulations expand your “what-if” analysis, and will either grow your confidence or highlight possible concerns in potential divorce settlement scenarios. Because future market returns are unknown, the best way to plan and prepare is with probabilities.

More Informed Settlements

My suggested approach is to use a divorce financial planning software program, like Family Law Software, to calculate support needs, individual living expenses, and dividing assets. With a base line, you can then model “what-if” scenarios and figure “equalization” payments.

Next, take your best possible scenarios and run them through a financial planning tool like eMoney. There are specific modules in eMoney called “interactive goal-base planning” and “decision center for interactive cash flow planning”, that use Monte Carlo simulation to stress test scenarios. This exercise is important for retirement planning, buying/selling decisions, etc..

Wiser Decisions

Consider the “what if” scenario where the wife, for many sentimental reasons, really wants to keep the house rather than take cash when dividing assets. She draws up her living expenses, underestimating much, but determines that she can make it work.

The initial projections look good to you but you have seen this before and are concerned. You have expressed your concerns to the client, but she is not persuaded and becomes upset at idea of letting go of the family home.

You run a stress test and see that she has a below average success probability for having enough assets through retirement.

With the Monte Carlo model, this tough news can be delivered objectively, while making it easier for your client to absorb. Many people struggle with “math anxiety.” Add divorce stress, life change, conflict, and emotions to that and spreadsheets don’t translate into helpful information to make a wise decision.

The Monte Carlo simulation presents financial data with easy-to-read and easy-to-understand images. You are free to hold the emotional space with your client as she considers the objective data from the stress test that keeping the family home really might not work. Maybe there is still time to renegotiate the settlement.

More Informed Future Planning

If the divorce is final, this analysis can still be done. Even if there are no other asset division options it’s not too late for your client to stress test her settlement to better inform her future financial decision-making.

Leverage a CDFA to Stress Test your Settlements

If you do not have the time or capacity to run these tests, leverage a certified divorce financial analyst. Most CDFAs only focus on using straight line assumptions, so make sure your CDFA can leverage the power of stress testing.

Your clients want to know they will be ok. Go the extra mile and run the stress test so your clients can feel secure and make better decisions.