Key Takeaways

-

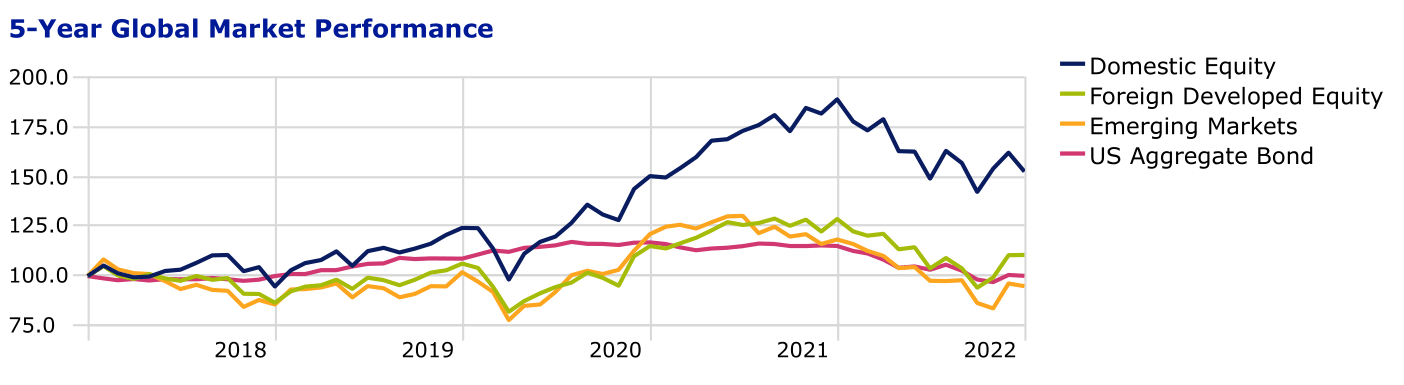

Global financial markets regain positive momentum during Q4, mitigate worst year for a balanced portfolio since 2008.

-

Headline inflation cools to 6.5% in December, ending the year well below 40-year high of 9.1% in June. Retail gas prices fall 5% in 2022 after surging over 50% by late Q2.

-

FOMC raises fed funds rate by 0.5% to an effective range of 4.25% to 4.50% after year-end meeting, marking their first “step down” in pace of rate hikes since June; signal two more increases in Q1 2023.

-

Unemployment rate drops back to 53-year low of 3.5% as December Jobs report proves resilience in labor markets.

-

Atlanta Federal Reserve Bank’s GDPNow forecasting model estimates Real GDP grew by an annualized rate of 4.1% during Q4. Low growth and mild recession expected in 2023.

-

Global manufacturing and services purchasing index indicates deceleration in US and abroad. Conflict in Ukraine continues to weigh heavily on U.K. & European markets as central banks battle inflation.

GDP

U.S. growth forecasts lift slightly for 2022, downgraded to 0.5% for 2023

Following two consecutive quarters of negative GDP growth, the U.S. economy avoided recession altogether in 2022. Real GDP (net of inflation) grew by an annualized rate of nearly 3% in Q3, and most recent projections for Q4 hover around 4% after upward revisions to growth of real personal consumption and real private domestic investment.

Despite solid recovery in the second half of 2022, the U.S. economy is losing momentum amid major headwinds seen around the world. With tighter financial conditions and even less accommodative monetary policy around the corner, many analysts’ base case is a mild recession sometime in 2023.

- Consumers prove resilient, slower growth expected as personal savings rates decline and debt accumulates.

- Home building and buying are falling sharply as mortgage rates doubled, however multi-family sector posting strong activity.

- Exports likely to be affected by the high dollar, though strong demand for U.S. energy and food commodities to provide relief.

Jobs

Wage growth slows as 223,000 payrolls added in December, unemployment rate dips to 3.5%

While the economy is threatened by recession in the year ahead, the December jobs report still supports the notion of a relatively tight labor market even as momentum slows. Jobs were added at a slower pace than prior moths, however labor force participation picked up and unemployment dipped to its lowest since the 60’s.

- Hiring robust across industries with exceptions to Information and Professional & Business Services, layoffs mostly confined to beleaguered tech sector.

- Average hours worked falls to lowest since April 2020, bringing down wage growth and potentially easing inflation.

- Total openings have fallen from peak of 11.9 million to 10.5 million according to latest data, though still incredibly high relative to history.

- Year-end unemployment projections range from 4.5%-5.0%.

Inflation

Headline inflation cools to 6.5% in December, Fed signals two rate hikes in 2023

Major hotspots of inflation have simmered down since the Consumer Price Index peaked in June. Energy prices have been declining for several months and easing supply constraints along with lower consumer demand has allowed some relief across core goods categories. Shelter inflation remains high, largely reflecting significant lag from pandemic related rent increases, and is expected to peak and begin decreasing soon.

The Federal Reserve remains dedicated to taming inflation and would like to see substantially more evidence before gaining confidence in the recent, promising downtrend. Goods inflation has turned down, but do not expect services inflation to move down as quickly. Wage growth is beginning to slow yet remains well above the 2% inflation target. Believing the labor market will come into better balance over time, officials reiterated staying the course until the job is done with clear plans to increase rates at their next meeting.

- Total cumulative rate hikes of 4.25% in 2022 are the most in a single year since 1980.

- Fed’s current median forecast for the fed funds rate in 2023 cap at 5.1% in 2023 and 4.1% in 2024.

- Still targeting a soft landing by not triggering recession, the Fed believes reducing inflation is likely to require a sustained period of below-trend growth and additional softening of labor market conditions.

- Consensus estimates for headline inflation by year-end range from 2.5%-3.0%.

International Outlook

U.K. officially enters recession as European Union expects to in 2023, China reopens

For many central banks, the battle with inflation is not quite over as we enter the first quarter of 2023. Like the Fed, plans for additional hikes to their main policy rates remain, however are expected to be completed by Q2 with any cuts likely waiting until 2024. Global manufacturing and services activity, as measured by the Global Composite Purchasing Managers’ Index, began decelerating in November in every developed and emerging market economy with exception to India.

Downside risks remain in 2023, most notably central banks overtightening monetary policy, broadening of the war in Ukraine, and the ongoing European energy crisis. Not unrelated, the reopening of China’s economy presents its own unique risks with pent-up demand of 1.4 billion consumers after a year of restrictions. With upside risks for earnings with Chinese sales exposure, it’s possible to see a rebound in global inflation for both commodities and goods – just as the rest of the world may be planning to pause rate hikes. While growth in China was slow in 2022, it’s expected to pick-up in 2023 and normalize in 2024.

2023 Consensus estimates:

- Euro area GDP 0.2%, Unemployment 7.1%, Inflation 5.8%

- U.K. GDP -0.8%, Unemployment 4.4%, Inflation 6.8%

- China GDP 5.0%, Unemployment 5.0%, Inflation 2.3%