Here a look into the market review and outlook on the recent activity in the US market over the fourth quarter of 2021.

Key Takeaways

- Two years into the Coronavirus pandemic, U.S. case counts are surging due to the rapid spread of the Omicron variant throughout the month of December.

- Latest estimates of U.S. Real GDP growth during fourth quarter range between 6-7%; feasible for economy to achieve trend growth sooner than expected amid Omicron and fiscal headwinds.

- S. labor market continues to tighten as unemployment rate falls to 3.9% in December, likely to reach 3.5% by end of 2022. Omicron likely to disrupt hiring in January and February.

- The 12-month inflation rate hit 7% in December, reaching levels last seen nearly 40 years ago, boosted in part by soaring energy prices, rising wages, and supply chain disruptions.

- Federal Reserve adopts more hawkish stance; accelerates reduction of asset purchases in light of inflation developments and solid job gains. Barring derailment, tapering should be finished in March and the first of three Fed rate hikes now likely in 2022 is expected to occur as early as June.

- Overall outlook for global economies and financial markets largely dependent upon new variants of the virus, reduction of fiscal support, and changes in central bank policy.

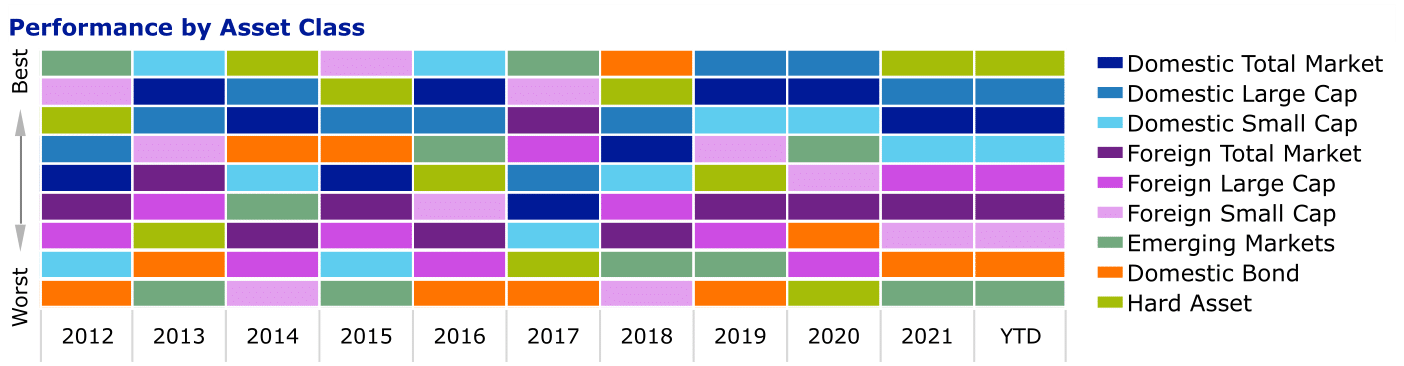

Performance by Asset Class

4th quarter GDP estimates upward of 7%; economic slowdown imminent heading into 2023

As of January 10th, the Federal Reserve Bank of Atlanta estimates fourth quarter GDP growth of 6.8%. As such, economic output levels are still on track to fully recover in the first quarter of 2022 by reaching its long-term, pre-pandemic projected growth trend.

- Since the economy previously recovered any recessionary losses caused by the virus, achieving trend growth is important to an investor because equity returns are closely tied to future potential.

- Most rebounding activity is behind us, so there isn’t much potential to exceed trend growth considering our current monetary policy is beginning to tighten with full employment on the horizon.

- Generally speaking, whenever the economy reaches the point it would have been had the pandemic never occurred, we expect growth to begin slowing throughout the year and return to its pre-pandemic average of 2% by year-end.

- Looking forward, January and February are typically the two slowest retail months of the year and are all but certain to be again as the Omicron variant reaches full swing and fiscal support is withdrawn from nearly 35 million households.

- Any reprieve amid these headwinds may allow time for various supply chain disruptions to begin catching up to demand and likely begin to push oil prices lower.

- FOMC estimates 4% GDP growth in 2022, 2.2% in 2023, and 2.0% in 2024.

Confirmed Omicron cases surging, hospitalizations less so—fatality rate steady

The Omicron variant began spreading rapidly in the beginning of December when the Delta variant still accounted for 99% of all cases. As of January 1, 2022, the Omicron variant now accounts for over 95% of all new cases.

- While the 7-day moving average of new case counts have skyrocketed to record highs, we must not forget that our testing capabilities have improved dramatically.

- The number of hospitalizations have only risen by an estimated 40% relative to the increasing number of confirmed cases.

- Likewise, the 7-day moving average of fatalities per 100 confirmed cases is little changed relative to numbers seen toward the end of the Delta wave. Please note, there is an average 18-day lag between confirmed cases and fatality recording. So, the month of January shall remain critical as to the outlook of Omicron and its effects.

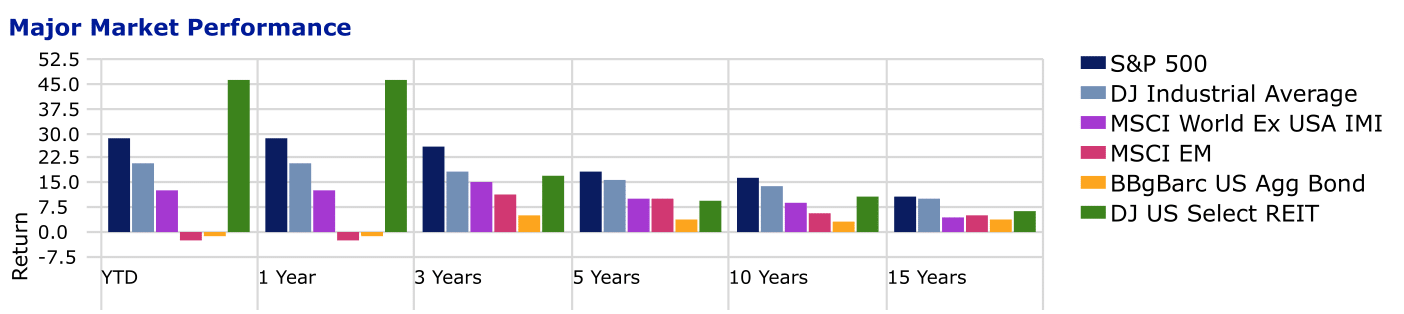

Major Market Performance

December jobs report: U.S. adds less than half expected new payrolls— unemployment rate beats estimates

The U.S. added 199,000 new jobs in December, less than half of the consensus expectation of 450,000. However, the unemployment rate improved to 3.9%, down from 4.2% in November. Furthermore, the FOMC estimates the unemployment rate to fall to 3.5% by year-end, which would effectively return the U.S. to full employment.

- Even though new payrolls were less than stellar, there’s still extraordinary, pent-up labor demand as evidenced by the current record number of job openings, low number of layoffs, and high number of job quits.

- This tightening in the labor market boosted private production and non-supervisory worker wages by 5.8% in 2021, well above the 50-year average of 4.0%.

- The Omicron variant is likely to disrupt hiring mid-December and may do so well into February.

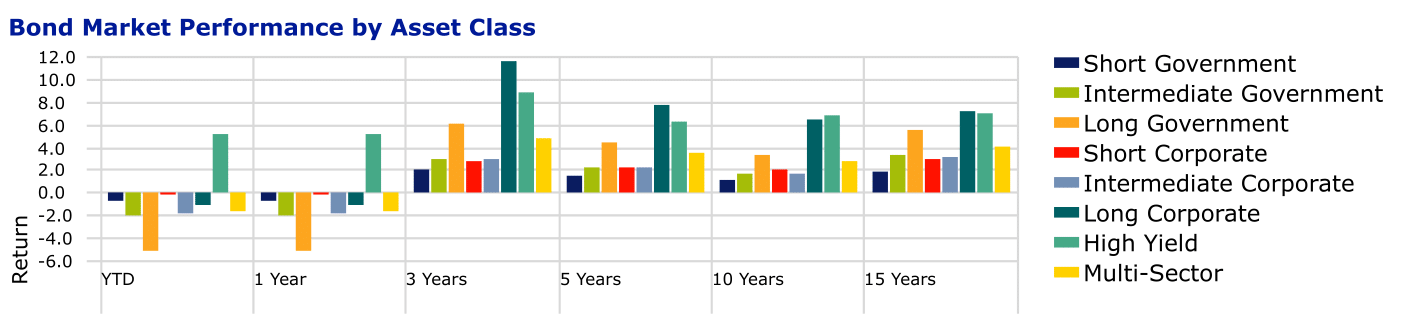

Bond Market Performance by Asset Class

Headline inflation hits 7% in December, a level not seen since June 1982

The Fed adopted a more hawkish stance toward monetary policy, formally acknowledging the rapidly improving labor market and persistent inflation in its December meeting. Also, officially announcing plans to accelerate the taper of its net asset purchases to $30 billion per month. At that rate, the timeline to complete tapering has moved up to March.

- Assuming inflation is still strong and the economy is growing at a moderate pace, we may see the first fed funds rate hike in June, potentially followed by two additional hikes in 2022 and three in 2023 as suggested by the Fed’s dot plot.

- While the Fed retired the word “transitory” from their statement, it’s worth noting some variables are certainly short-term in nature, such as energy prices soaring 30% for the year, and should not continue to accelerate at the same pace.

- Given how quick an approach to full employment with a modest pickup in labor force participation, wage growth should remain robust.

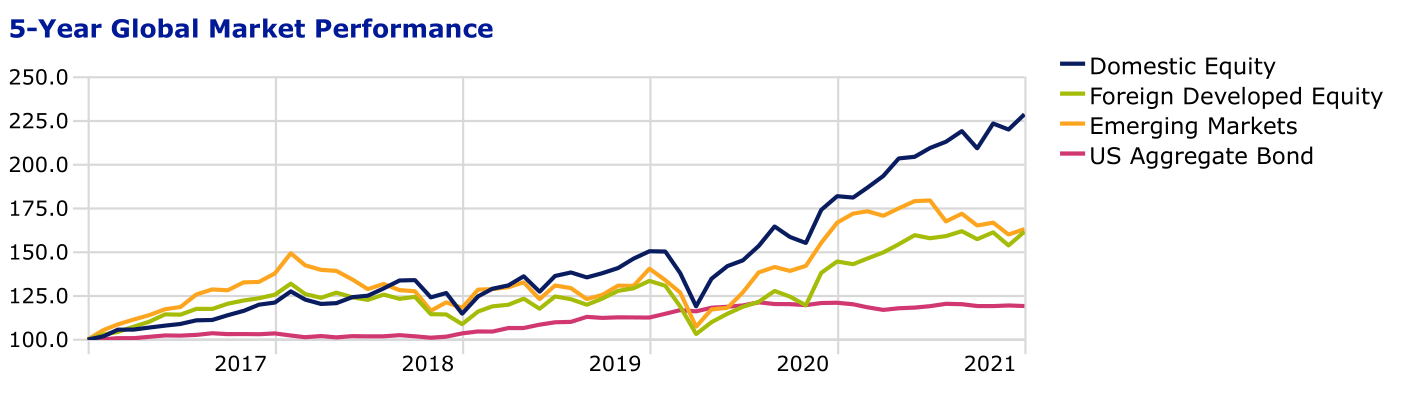

5-Year Global Market Performance

Despite divergence in health and economic outcomes, likely potential for outperformance vs U.S. in coming decades

Recovery is underway, but most developed and emerging economies are facing many of the same hurdles to varying degrees. Economic momentum has slowed due to familiar headwinds, intensifying supply-chain disruptions, and more recently a tightening of restrictions due to the emergence of the Omicron variant.

- Recent gains in the U.S. Dollar and long run downward pressures will enhance future international returns, especially taking U.S. equity valuations into account as current P/E ratios are running well above 20-year averages with one exception – Small Cap Value.

- Central banks set to continue accommodative policy after their pandemic specific tapering is complete despite mounting inflationary pressures. Euro area growth is projected to be around 4% for 2022.

- Bank of England committed to firm but cautious tightening path, expecting to grow about 5.5% in 2022.

- China’s headwinds to intensify amid transition toward a new policy paradigm with regulatory tightening ramping up across all sectors of the economy especially in property and energy.

- Most economic risks to emerging market growth forecasts are skewed to the downside, stemming from the growing potential of accelerated tightening of central bank policy in developed markets, but material upside exists with potential global commodity price shocks.

Download a copy of this report here.