Read more below to find our market review and outlook on the recent activity in the US market over the second quarter of 2022. Download the full report here.

Key Takeaways:

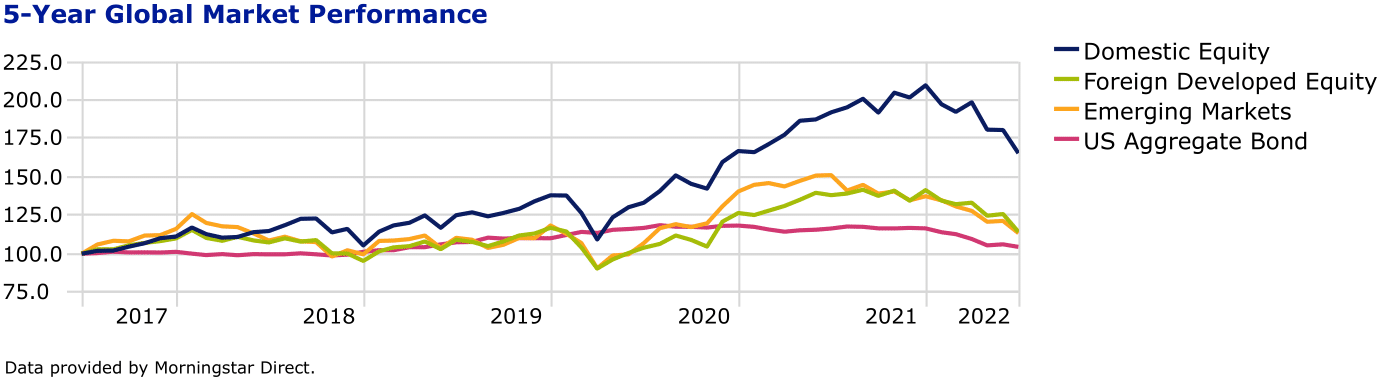

- As impacts of COVID-19 continue to fade, optimism of the post-pandemic recovery has met the harsh reality of high inflation and more restrictive monetary policy.

- Fears of recession continue to mount as stock market losses, surging mortgage rates, and record-low consumer sentiment undermine economic momentum.

- S. GDP retracts by 1.6% in the first quarter; full-year growth expectations downgraded to 2.0%

- Jobs report posts stronger than expected growth; unemployment rate remains steady at 3.6% for fourth consecutive month.

- The Federal Reserve raises its federal funds rate target by 0.75% in June as headline inflation edges over 9%.

- Global economy may narrowly avoid recession; financial markets to remain under pressure as tighter financial conditions increasingly hamper demand.

U.S. growth outlook downgraded - pace of expected deceleration likely quickened

Entering the second half of 2022, there is growing danger that the economy could slip into recession. While real GDP shrank in the first quarter, monthly economic data suggests solid growth in the second quarter of around 1.5%.

As the Omicron wave subsided, spending increased in sectors most affected by the pandemic such as travel, restaurants, leisure, and entertainment. However, there are significant headwinds looking well into 2023 that increase the probability of entering a period of slow growth given the economy avoids recession.

- The federal budget deficit is likely to fall from 12.4% of GDP to less than 4% this year, reflecting an end to a host of COVID related relief programs which boost consumer spending.

- An overvalued dollar has tempered international trade, decreasing exports and increasing the deficit.

- The housing sector and related activities are being battered by the surge in 30-year mortgage rates.

Economy adds 372,000 jobs in June - unemployment rate remains unchanged at 3.6%

The labor market continues to be a bright spot in an otherwise gloomy environment with significantly more jobs added than previously estimated (275,000). Wages are up 6.4% relative to this time last year, and there are still millions more job openings than unemployed workers. At a time when talk of recession dominates most investment conversations, the continued strength in the labor market provides an important tailwind for the economy against the risks of increasing inflation and deteriorating consumer sentiment.

- The labor force fell by just over 350,000, highlighting the demographic drag on labor supply which may even keep unemployment low if job growth begins to falter.

- Wages continued to grow at a moderate pace of 0.3%, following a 0.4% advance in May, and there are now 1.9 job openings per unemployed worker.

Headline inflation posts new high for 2022 - cresting just over 9% in June

The Consumer Price Index continues to run well above market expectations. Today's high inflation largely reflects the impact of surging consumer spending, fueled by fiscal stimulus, colliding with persistent supply shortages across major sectors of the economy. These problems have been amplified by Russia's brutal invasion of Ukraine and China's attempt to maintain a zero-COVID policy, compounding supply chain disruptions and energy prices.

However, recent data has shown signs of abating inflation. The national average price of gasoline has fallen over $0.30 since hitting a peak of over $5 per gallon, airfares appear to have declined in June and into July, and used vehicle prices decreased by 1.3%. While this data has come too late to affect June's readings, the trend could lead to lower inflation in July and August. Several projections show potential for inflation to decline to 7.5% and 5.5% by the end of the third and fourth quarters, respectively.

- The Federal Reserve responded with its largest rate hike since November of 1994, and this increase of 0.75% lifts their current target federal funds range to 1.5%-1.75%.

- As several officials are advocating for a second 0.75% increase in July, further rate hikes are anticipated to end the year in the range of 3%-3.5% and settle between 3.75%-4% in 2023.

- The Fed's greatest risk is raising rates too quickly before their impact can be accurately measured. By potentially worsening international trade and new housing starts, the Fed could trigger a recession and find themselves reversing course next year.

- For the long-term health of both the economy and financial markets, the Fed must gradually increase interest rates to economically sensible levels and keep them there.

Inflation now a global concern - ECB signals first rate increase since July 2011

The global economy presents a mixed picture as we enter the third quarter. On the positive side, the effects of the pandemic are fading in most parts of the world due to widespread immunity gained from both inoculation and infection. However, the Chinese economy continues to be impacted by the pandemic as they struggle to sustain a zero-COVID policy, opting for harsh lockdowns which significantly hamper any economic activity.

European economies, undoubtedly affected by the war in Ukraine, are suffering too as energy prices rise to remarkably high levels. And as central banks tighten policy to bring inflation under control, many analysts do not believe this to imminently trigger a global recession. Downsides remain to both earnings and aggregate demand which will slow the pace of economic recovery around the world.

- May inflation readings hit 9.1% in the U.K. and just over 8% in the European area.

- In response, the Bank of England recently raised its main policy rate for the fifth time to 1.25%, and the European Central Bank (ECB) announced its intent to hike rates for the first time in over a decade.

- 2022 GDP estimates for the U.K. are now in the 3.5%-4% range, 2.5%-3% for the European area, and around 3% for China and other emerging markets.