Read more below to find our market review and outlook on the recent activity in the US market over the first quarter of 2022. Download the full report here.

Key Takeaways:

- The vast majority of Americans are now fully vaccinated, previously infected or both, and this immunity is gradually reducing fatalities even with the very contagious Omicron strains.

- By the end of 2021, the U.S. economy has not only recovered its pre-recession output level but has exceeded it by more than 3%.

- The labor market continues to improve rapidly as the unemployment rate fell to 3.6% in March, down from 6.0% this time last year.

- Inflation heated up significantly over the past year as surging consumer spending, fueled by fiscal stimulus, collided with supply shortages across major sectors of the economy.

- At its March meeting, the Federal Reserve increased the federal funds rate by 0.25% and signaled their intention to raise rates at each of the remaining six meetings in 2022.

- High inflation, falling unemployment, and the Fed's much more restrictive stance led to a sharp backup in bond yields in the first quarter of 2022, leading to negative returns across fixed income markets.

Economic impacts of COVID-19 on the global economy beginning to fade

As the first quarter of 2022 drew to a close, the 7-day moving average number of fatalities in the U.S. fell below 1,000 people per day compared to more than 3,000 per day a year earlier. While a still horrific total, current estimates are now between 500-600 per day.

- The 7-day moving average number of confirmed cases has fallen dramatically to less than 30,000 per day, which peaked at over 800,000 per day mid-January 2022.

- High-frequency economic data continues to improve. The chart below compares present data with pandemic lows respectively to pre-pandemic weeks in 2019.

- Consumer debt/credit transactions

- Low: -34% Current: +29%

- Hotel occupancy

- Low: -69% Current: -6%

- S. seated diners

- Low: -100% Current: -1%

- TSA traveler traffic

- Low: -96% Current: -9%

4th quarter 2021 Real GDP growth accelerated to 6.9%; growing by 5.6% for the year

Strength was led by consumer spending, nonresidential fixed investment, export growth, and strong inventory investment particularly among motor vehicle dealers. While the Omicron wave appears to have slowed the economy in the first quarter of 2022, the second quarter is expected to be spurred by robust consumer and business spending.

- Fourth quarter earnings season was solid with 75% of companies exceeding earnings expectations and 69% beating revenue expectations.

- Overall, growth is expected to fade throughout the year as the economy reaches capacity limits, primarily due to a shortage of workers and more restrictive monetary policy.

- Current U.S. GDP growth estimates for 2022 range between 2.5% and 3.5%

Unemployment rate drops to 3.6% in March; labor force participation rate ticks up

Companies hired workers at the sharpest pace since April 2021 while supply disruptions eased and demand rebounded from Omicron. March nonfarm payrolls rose by 431,000 with upward revisions of 95,000 to the prior two months. Wages grew 0.4%, and upward revisions to February showed the year-over-year gain in wages hit a recovery high of 5.6%.

- The labor force also grew by 418,000 with women returning to the job market in greater numbers.

- Signs of a very tight labor market likely mean an even more hawkish Fed and higher interest rates in the months ahead.

- Excess demand combined with rising wages, fading pandemic effects on labor supply, and the elimination of most pandemic assistance should lead to further declines in the unemployment rate.

- Current unemployment rate estimates for year-end range between 3.3% and 3.5%.

Headline inflation soars to fresh 40-year high of 8.5% in March

While higher oil prices stemming from Russia's invasion of Ukraine have increased upside risks to inflation and downside risks to growth, broader inflationary pressures persist. Strong gains in wages, rents, and inflation expectations will probably keep inflation stubbornly high.

- However, despite the invasion and growing number of COVID cases in China, supply chains are still expected to recover in the year ahead.

- In addition to raising rates, the Federal Reserve plans to accelerate their pace of balance sheet reduction to help keep a lid on inflation, which is likely to run above their target by year-end with generational low unemployment levels.

- Provided that inflation is easing throughout the year, the Fed may decide to adopt less restrictive policies in 2023 to avoid triggering a recession.

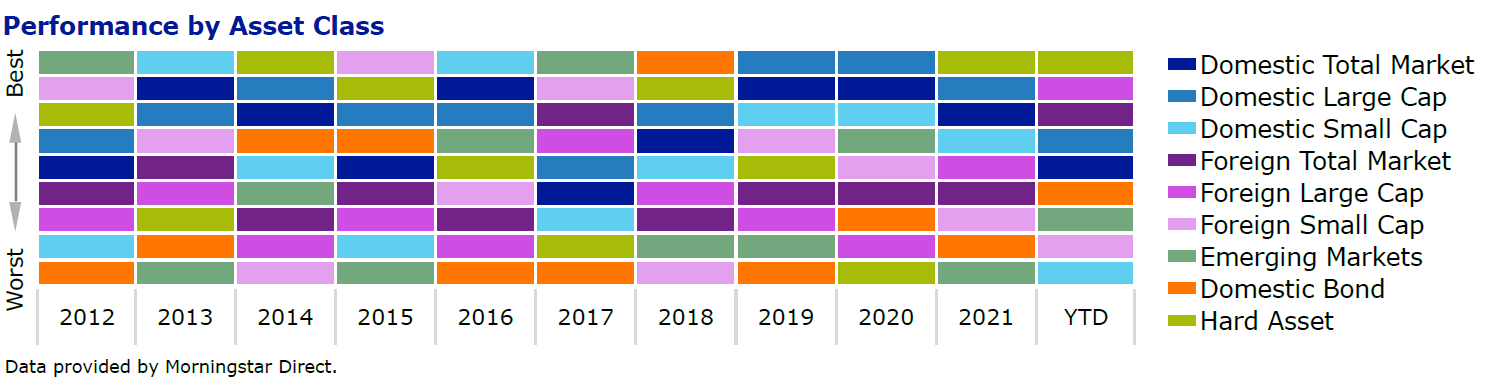

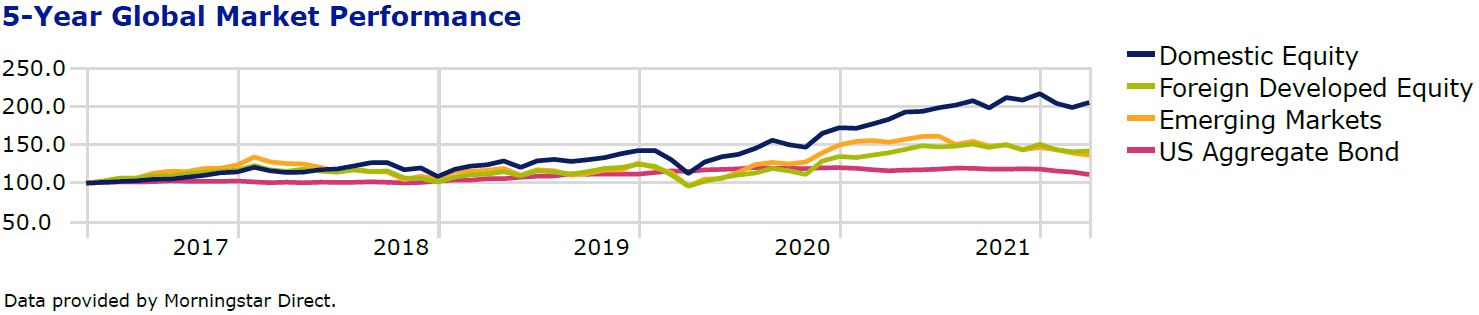

Long term growth prospects, potential of a falling dollar, and cyclicality support int'l equities

While Omicron and the Russian invasion of Ukraine have hindered the global economic recovery in early 2022, the recovery is likely to continue, powered by post-pandemic reopening and more active fiscal policy in Europe.

- Global economy expected to continue to grow at a faster-than-trend rate over the next two years with robust earnings growth acting as an important catalyst for international markets.

- Valuations remain attractive with both emerging market and developed market stocks at some of their cheapest levels relative to the U.S. in the last 20 years.

- Lower trade tensions and the prospect of lower dollar in the long run argue for a greater allocation to international equities, with a particular focus on East Asia and Europe.

- Investors should focus on what they own and valuations instead of when to buy and sell, based on how they feel about the world.