Key Takeaways

- Amplified by declining prices in 2020, headline inflation remains over 5% for fourth consecutive month.

- Federal Reserve expected to begin reducing monthly bond purchases by year-end and keep rates low until late 2022.

- International equities gain attraction amid encouraging signs of declining hospitalizations and fewer new daily case counts in most key economies.

- COVID-19 resurgence delayed synchronized global recovery during the third quarter even though vaccination rates increased dramatically overseas.

- Despite relatively weak third quarter, U.S. Real GDP reaches pre-pandemic output levels from year-end 2019.

- U.S. unemployment rate falls well below consensus estimates despite disappointing September jobs report.

-

-

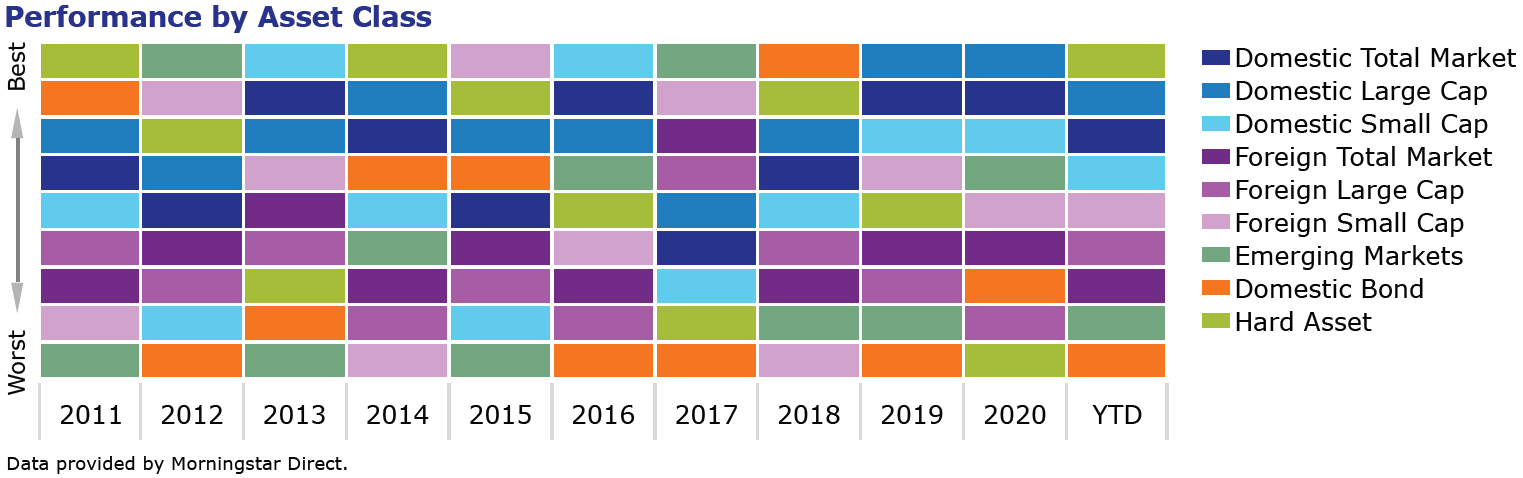

Performance By Asset Class

U.S. economic activity expected to reaccelerate during 4th quarter - fully recover in 2022

Although global growth has slowed recently, the U.S. economy should fully recover from the pandemic during the first quarter of 2022. This will occur when actual GDP rises to the level of GDP forecasted by its long-term growth trend had the economy continued to expand instead of entering recession in the first quarter of 2020.

- COVID-19 Delta variant, supply chain disruptions, and inflation concerns hamper growth, decreasing estimates to around 2.0% on an annualized basis for the third quarter and 6.0% total for the year.

- Should growth reaccelerate to 5.5-6.0% in the fourth quarter, this momentum is expected to carry into first quarter 2022 before moderating and returning to long-term averages by the end of the year.

- Future fiscal stimulus is anticipated to stretch out over the next decade and be partially offset by tax increases, ultimately providing much less support to the economy than seen over the last two years.

September jobs report sends mixed messages - highlights shortages of labor supply

Full employment remains elusive after jobs report disappoints expectations. Conversely, rising wages and falling unemployment indicate strong demand for labor as total job openings exceed number of unemployed.

- The U.S. unemployment rate improved well beyond estimates to 4.8%, reaching the Federal Open Market Committee's (FOMC) forecasts ahead of year-end.

- At odds with decreasing unemployment, only 194,000 net new payrolls were added in September, falling well short of previous gains this year which have averaged over 550,000 per month.

- As there are currently 10.4 million job openings and 7.7 million unemployed workers in the U.S., employers have had to increase wages to attract and retain workers. Hourly wages have risen by 5.1% per year over the last two years for private production and non-supervisory workers.

Inflationary pressures mounting - Federal Reserve believes to be transitory

As rising wages, decreasing unemployment, and surging consumer demand have clashed with supply chain disruptions across various sectors of the economy, the rate of inflation has exceeded the Federal Reserve's targeted rate of 2.0% since March of this year.

- For the fourth consecutive month, the Consumer Price Index (CPI) has risen more than 5.0% relative to its level 12-months prior, well above its annual long-term average of 3.2%.

- Inflationary goals set by the Federal Reserve are stated in terms of the Personal Consumption Expenditure price index (PCE), which measured inflation over 4.0% for the third consecutive month.

- While debate ensues over the Fed's assessment of recent spike as "largely reflecting transitory factors," the Congressional Budget Office forecasts the CPI to moderate to 2.7% for 2022 and average just below 2.5% throughout the decade.

Fed expected to announce tapering of bond purchases during November meeting

Monetary policy has been extremely accommodative since the Fed committed to promote its maximum employment and price stability goals for the economy during the onset of the pandemic. Shifting to a slightly more hawkish stance, Fed signals that tapering its bond purchases "may soon be warranted."

- In general, the committee acknowledged significant progress has been made toward achieving their economic goals and expects the broader economy to perform well in years ahead.

- Even as Fed notes how recent inflation and COVID-19 case counts have impacted the most adversely affected sectors of the economy, job growth is expected to remain solid as companies are paying more to attract workers.

- Since policy will continue to support credit markets and the overall economy until further progress has been made toward maximum employment, rate hikes are not expected until late 2022 or 2023.

Key economies poised for synchronized recovery - many surpass U.S. vaccination rate

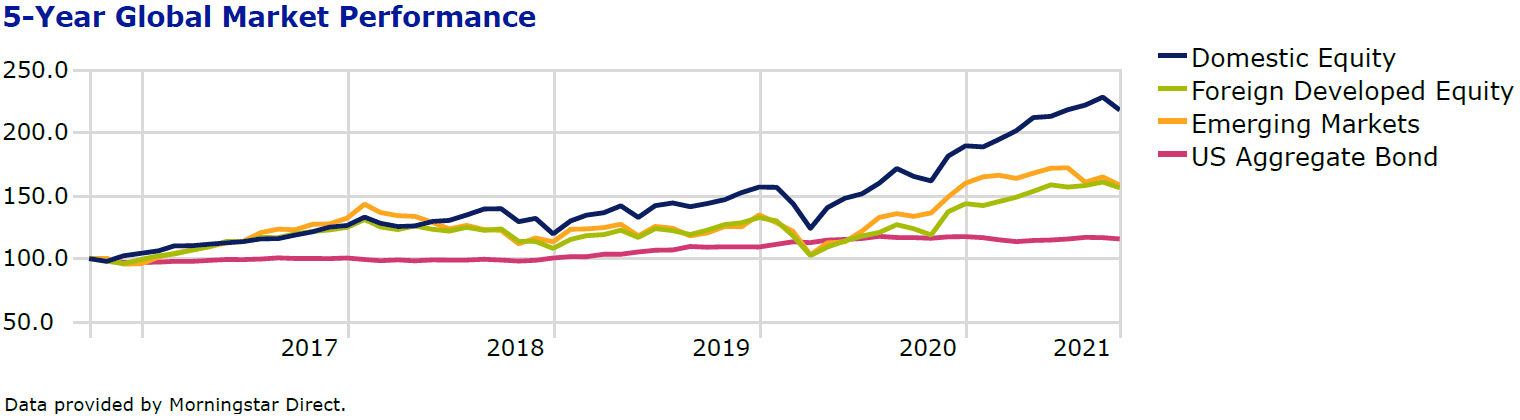

Developed market equities gain attraction as effects of the Delta variant appear to have peaked amid declining hospitalizations and fewer new daily case counts. Further, as cyclical stocks make up a greater portion of international equity indices relative to the U.S., developed markets offer potential for greater participation in global recovery due to higher cyclical exposure and lower relative valuations.

- European Central Bank revised growth forecasts upward from 4.6% to 5.0% and announced a reduction in asset purchases while emphasizing there are no plans to taper purchases down to zero.

- Global economic activity momentum, as measured by the Global Composite (manufacturing & services combined) Purchasing Managers' Index, is expected to indicate acceleration for nearly every major global economy by year-end.

- Lastly, emerging and developed international markets continue to sell at some of their lowest levels relative to U.S. equities during the past two decades.