The CARES (Coronavirus Aid, Relief, and Economic Security) Act, passed by the Senate on Wednesday and the House of Representatives earlier today, has now officially been signed into law by President Trump.

The Act represents the most expensive economic aid package in American history, more than doubling the stimulus bill passed during the 2008 Great Recession.

With more than 800 pages worth of stimulus measures, the CARES Act will attempt to curb the economic crisis that the coronavirus outbreak has caused, and will provide $2.2 trillion in economic aid.

Recovery Payments for Individuals

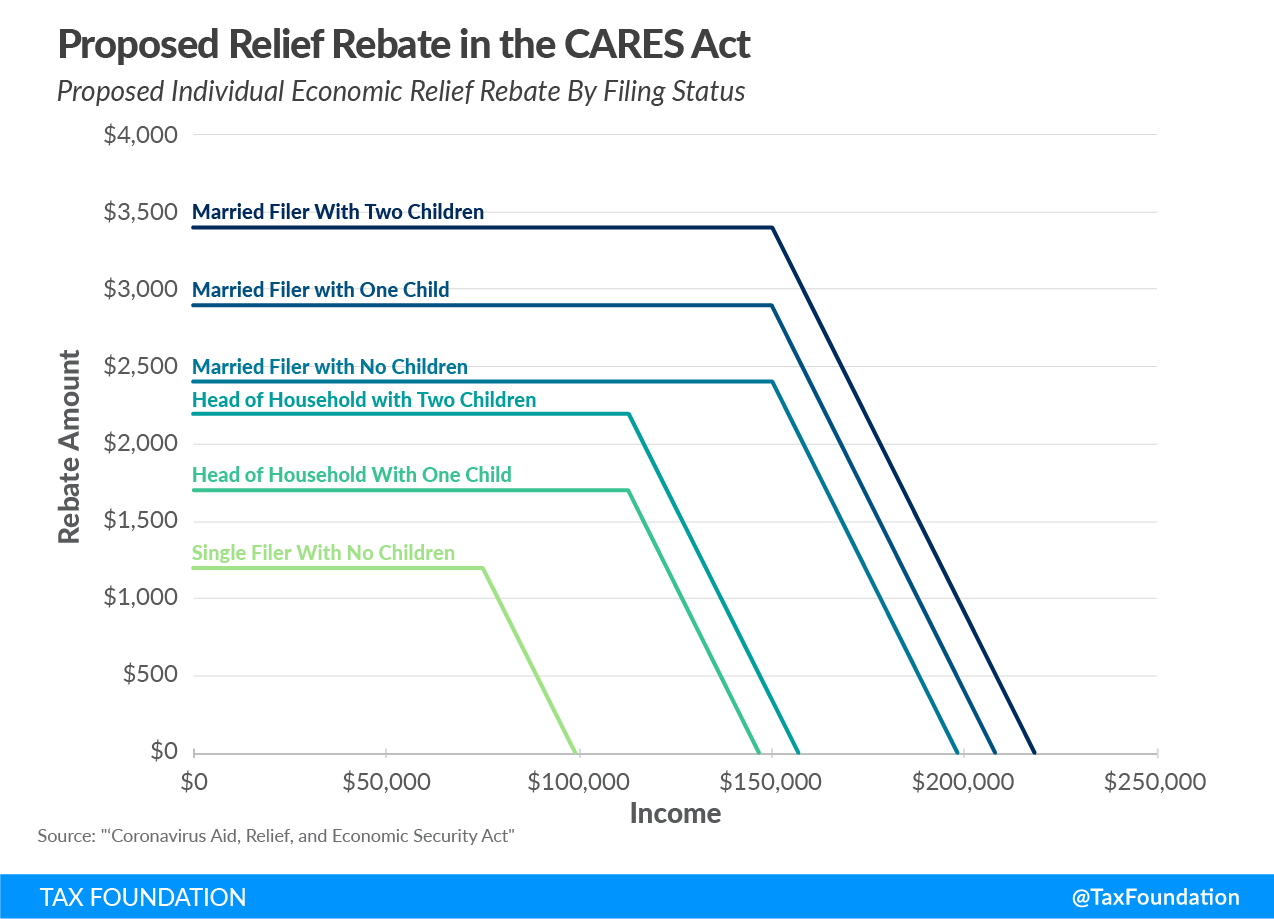

Under the new bill, most Americans, working or not, will receive checks up to $1,200. Married couples are eligible for up to $2,400, with an extra $500 for each dependent they have.

The amounts begin phasing out above certain income levels. For individuals, the phase-out range is $75,000 to $99,000. For married couples, the range is $150,000 to $198,000. There are provisions that may allow you to qualify if your 2020 income falls below your 2018/2019 income level.

These refundable tax credits are expected to be direct deposit (if that’s how you received your tax refunds) or checks if you did not provide direct deposit info on prior tax returns.

Unemployment Assistance

Besides potentially getting cash payments in early April, unemployed Americans will receive additional benefits. Groups that normally don’t qualify for unemployment benefits—freelancers and furloughed workers—will qualify under the new plan.

The maximum amount that each state hands out to unemployed workers every week will increase by $600, thanks to funding from the federal bill, for up to 4 months.

Small Business Assistance

Small businesses (500 employees or less) will get $367 billion in forgivable loans to help meet payroll, health insurance, rent, mortgage interest and utility expenses. Loans may be forgiven if a firm uses the loan for payroll, interest payments on mortgages, rent, and utilities and would be reduced proportionally by any reduction in employees retained compared to the prior year and a 25 percent or greater reduction in employee compensation

Need help? Schedule a free consultation with a Glass Jacobson small business CPA.

The maximum loan amount is $10 million. The exact amount is based on previous payroll records. The interest rate is capped at 4%, and the origination process for one of these special loans will be expedited.

Additionally, small businesses may qualify for a refundable payroll tax credit of a varying amount, depending on the number of employees.

To keep up to date on when these programs become available, stay in

contact with your local Small Business Administration District Office, located here.

For more details on these small business loans, click here.

For additional resources, check out additional COVID-19 Resources for Small Business Owners.

Tax Advantages

In addition to helping small businesses with funding, there are some tax benefits included in the Act. Some changes include modifications to the Net Operating Loss (NOL) limitations and carryback rules, Qualified Improvement Property is now eligible for 100% bonus depreciation, and the business interest limitation has been increased.

Student Loans

The new bill, which is equivalent to half the government’s annual budget, hasn’t forgotten about students. They can postpone payments on loans for up to 6 months and still retain their Pell grants. Interest that accrues during a payment suspension will be waived.

If students don’t spend the money they receive from loans or Pell grants, they can keep it. Moreover, students who leave school because of the pandemic won’t lose eligibility for Pell grants in the future.

Retirement Accounts

The Act also includes changes to retirement distribution rules, including suspension of the early withdrawal penalty and Required Minimum Distributions (RMD).

For more information, read: What the CARES Act Means for Your 401(k) and IRA.

Evictions and Foreclosures

Borrowers who have federally backed mortgages will have 60 days of forbearance (delay in foreclosure), starting from March 18th. The 60-day period increases to 90 days for multi-family properties. Owners of such properties who receive forbearance cannot charge late fees or evict tenants during the grace period.

The bill grants up to 6 months of forbearance to homeowners who have economic difficulties due to the epidemic and who have federally backed mortgages purchased by Fannie Mae, Freddie Mac, or insured by HUD, VA, or USDA. Individuals must apply with their applicable mortgage servicer to take advantage of this provision.

Health Care

Over $100 billion of the $2.2 trillion will be used to fund health care services. This is a massive increase over the original $15 billion in the first draft of the bill.

Funds will be sent to hospitals, the Centers for Disease Control and Prevention, child nutrition services, and public transportation.

Will the CARES Act be enough?

Despite the stimulus bill’s enormous size, economists along with Treasury Secretary Mnuchin have cautioned that the CARES Act can only keep the economy afloat for a few months, given the far-reaching consequences of the epidemic. How much more the U.S. government is willing and able to spend is unknown at this time, but is a question that may eventually have to be answered.

Still have questions?

If you need help figuring out how this lengthy bill affects you, email our Coronavirus Response Team at cvrt@glassjacobson.com or schedule a free consultation below.

Want to RECEIVE COVID-19 UPDATES?

Enter your email below and we'll keep you updated!