Markets abhor uncertainty, and there is no shortage of it amidst the last few weeks of trading and enduring volatility.

Fueling these headwinds are highly unusual economic circumstances impacting our financial markets:

- Inflation rising to levels not seen in forty years,

- Federal Reserve policy attempting to curb inflation with rapid interest rate increases,

- High energy prices impacting businesses and Americans’ daily lives nationwide,

- Geo-political uncertainty due to war in the Ukraine, and

- Prolonged supply-chain disruptions caused by Covid and Chinese shutdowns.

Despite these factors, we do not anticipate a recession in the short-term as aggregate U.S. economic fundamentals remain modestly strong. Unemployment rates are once again challenging 50-year lows as millions of job openings remain in excess of available workers seeking employment. Family incomes are continuing to rise, and corporate earnings are proving resilient in reaching historic highs this year. Also, new tax-increase legislation has become extremely unlikely, and GDP growth remains in positive territory.

Markets are forward looking machines, trading on information and the uncertainty of an economic outlook. Present market pessimism is rooted in the fear of an imminent recession. Rather, the chances of recession are now elevated in the intermediate-term due to rising inflationary data and the ensuing need for the Federal Reserve to increase short-term interest rates. All else being equal, the pace at which the Fed increases rates is critical in determining whether or not the economy enters recession sooner, later, or if at all – the lattermost being an optimal scenario resulting in controlled, slow growth.

Market downturns are very normal, in-fact healthy, and keep stocks from inflating into an unsustainable bubble. As reactive investors panic, there are always buyers willing to purchase investments at a discount from those who failed to plan or lost the will to stand firm in their investment strategy.

Your recommended asset allocation strategy is designed exactly for these inevitable pullbacks, and the subsequent investment diversification assures you need not sell while markets are down. Thus, maintaining course allows the portfolio to participate in any sharp recoveries thereafter. We concur with the data-driven sentiment on continued economic strength, anticipate that markets will eventually reflect that strength, and remain committed to wisely guiding the long-term success of your investments as your fiduciary advisors.

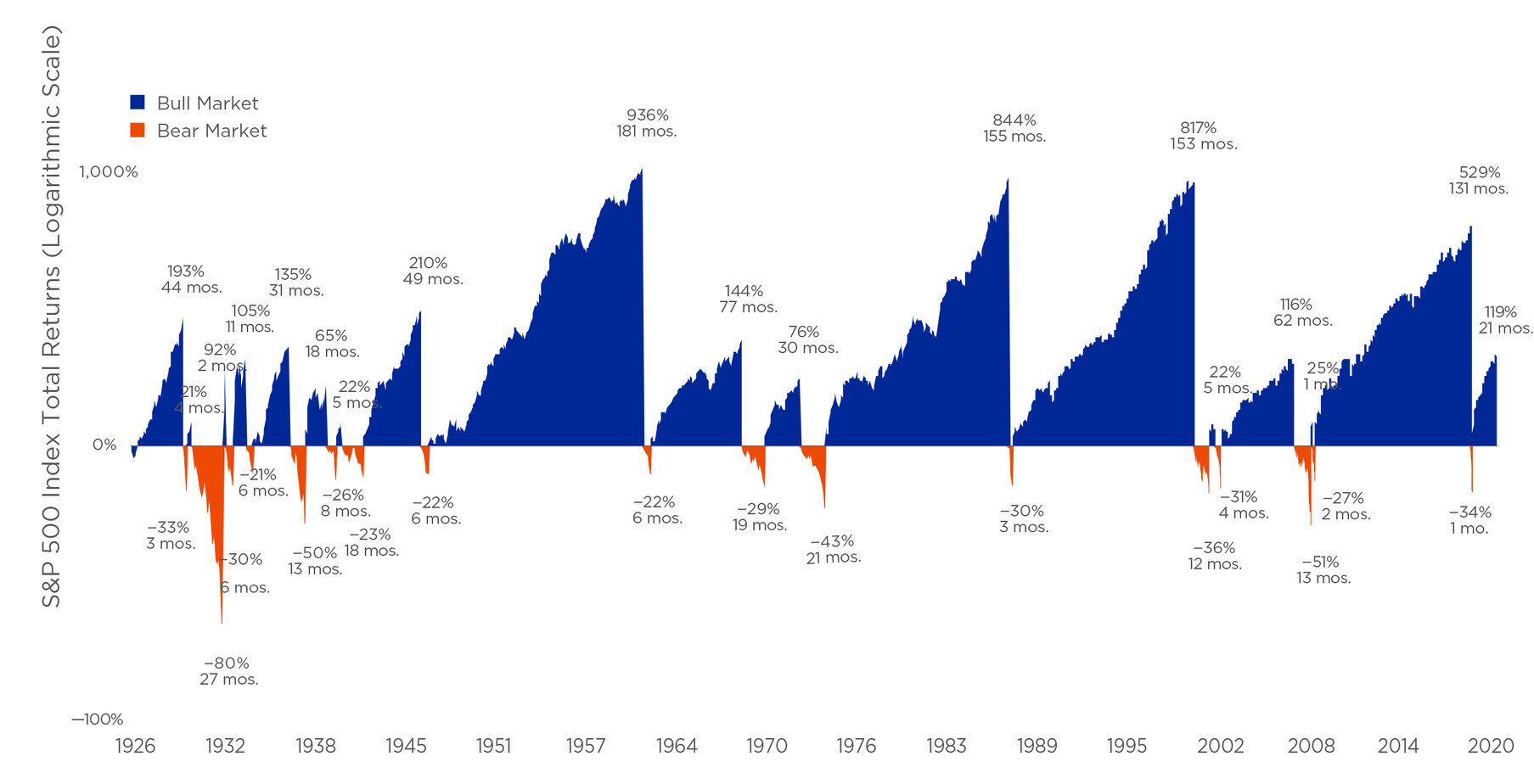

Investment success belongs to the diligent. Almost a century of bull and bear markets have simply proved the power of maintaining course through either cycle as seen in the chart below:

S&P 500 INDEX TOTAL RETURNS

January 1926–December 2021

- The 17 bear markets on-average lasted 10 months and declines ranged from -21% to -80% (Great Depression).

- The 18 bull markets on-average lasted 55 months and advances ranged from 21% to 936%.

Maximized time in the market is the key to this success, not timing the market. The sharpest periods of appreciation happen when bear markets swiftly reverse course. Take for instance the last fifteen years:

If you invested $10,000 in the S&P 500 on January 1, 2007, just before the start of the 2008 great recession, and did nothing else, that investment would have increased to $45,682 on December 31, 2021 (10.66% annualized total return).

- If you did the same but missed the 10 best trading days in those 15 years, your appreciation would be cut by more than half and only worth $20,929 (5.05% annualized).

- If you missed the 30 best days, your investment would have lost $8,365 (-1.18% annualized).

If you have any questions or concerns, please contact us at your convenience.

Download the PDF version of this post here.