AUTOMATED INVESTMENT PROGRAM (AIP)

Forge your path to financial freedom with the integration of

financial planning and investment advice.

financial planning and investment advice.

Get Started

AIP Overview

Combine the power of investment management automation with financial planning for your

comprehensive wealth management solution. Our investment solutions include globally

diversified, low-cost portfolios built by a team of investment management analysts, tax advisors,

and financial planners.

comprehensive wealth management solution. Our investment solutions include globally

diversified, low-cost portfolios built by a team of investment management analysts, tax advisors,

and financial planners.

PERSONALIZED

Open an account that meets your needs with a variety of account options.

Portfolios designed to fit your investing style.

Financial Planning tailored to meet your personal goals.

AUTOMATED

Automatic rebalancing maintains your chosen risk exposure.

Tax loss harvesting provides tax-wise trading strategies.

New deposits are automatically invested.

EFFORTLESS

Link your bank account to make deposits and withdrawals easily.

Work with our team of Wealth Advisors and CFP®s to make sure you’re meeting your goals.

Get started with as little as $5,000

READY TO LET OUR AUTOMATED PROGRAM

WORK FOR YOU?

Get Started

AIP Investing

Portfolios Designed To Fit Your Style

Select the investment style that is right for you. We have designed portfolio solutions for multiple investment strategies, including traditional and socially responsible themes. Invest according to your values and what is most important to you.

Explore our portfolio options

Invest With A Purpose

Selecting the right account type makes a difference. Invest on a tax-advantaged basis, generate income, or save for a variety of other purposes. Contact us with questions if assistance is needed to make a selection.

Which account type is right for me?

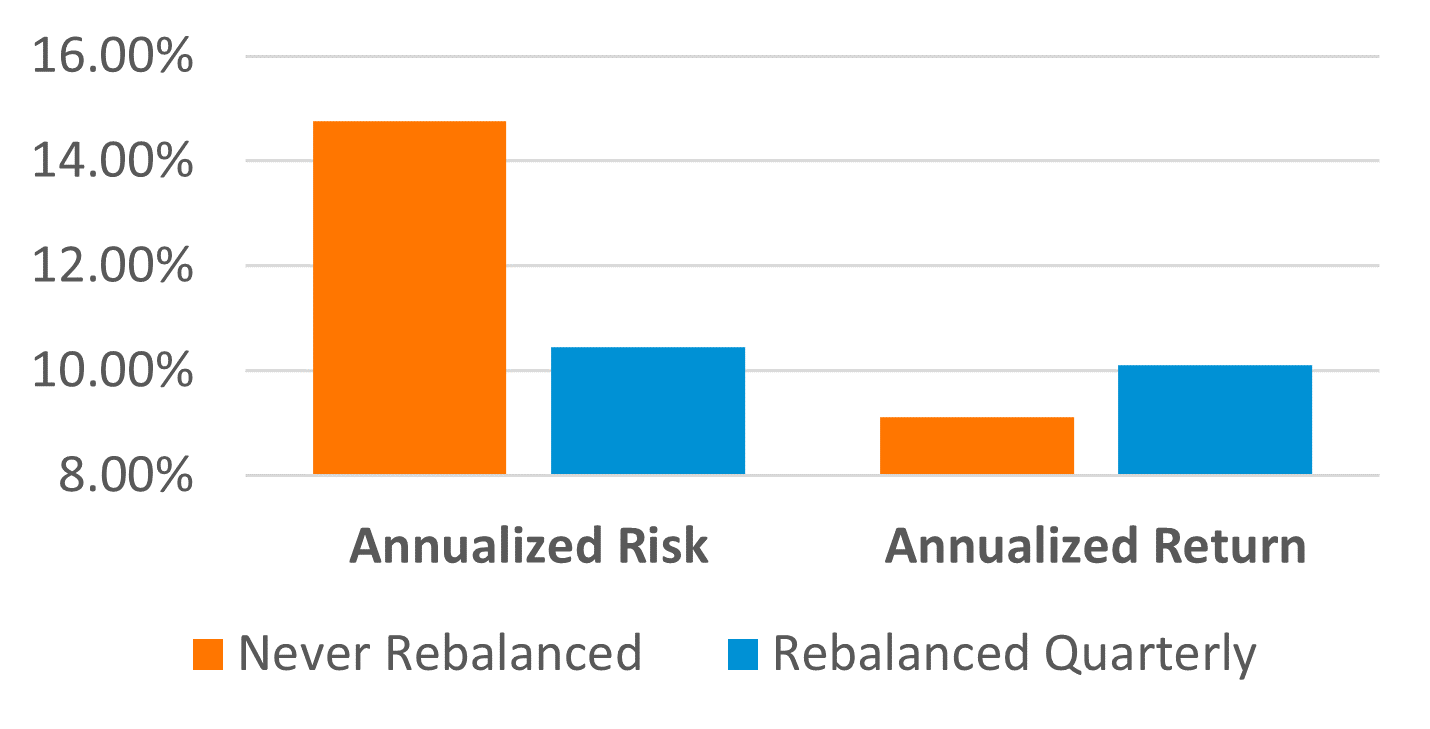

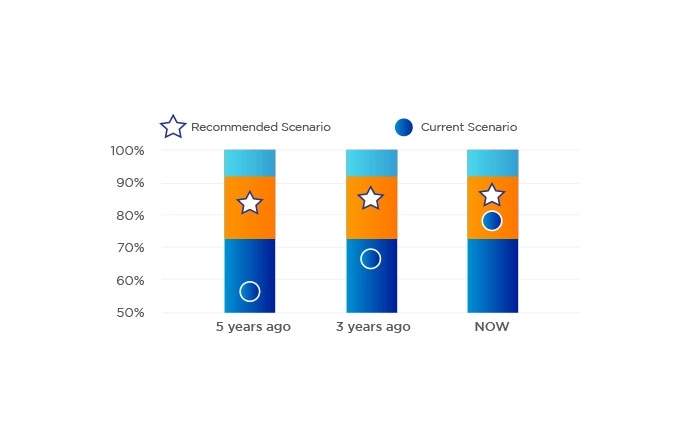

Higher Return With Lower Risk

Let The System Work For You

Intelligent algorithms drive automatic rebalancing and tax-loss harvesting strategies, paired with 24/7 access and low fees to help achieve your financial goals.

AIP Financial Planning

Manage The Now, Empower The Future

Combine the power of investment management automation with financial planning for your

comprehensive wealth management solution. Our investment solutions include globally

diversified, low-cost portfolios built by a team of investment management analysts, tax advisors,

and financial planners.

comprehensive wealth management solution. Our investment solutions include globally

diversified, low-cost portfolios built by a team of investment management analysts, tax advisors,

and financial planners.

Get Started

Get Organized

Integrate online accounts, create customized budgets, track investments and net worth, and prioritize future needs, wants, and wishes all in one easy to use dashboard

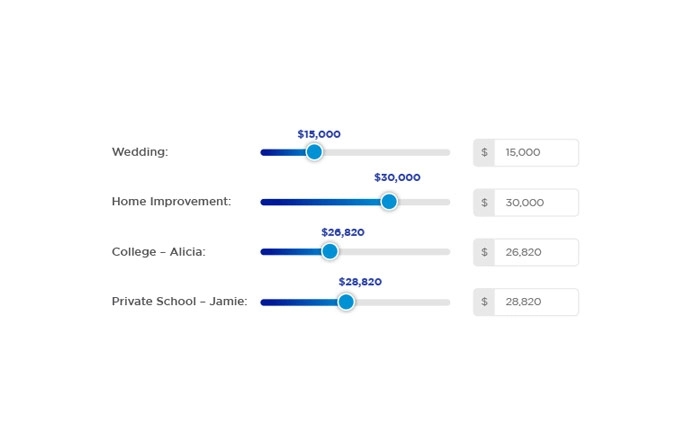

Plan Your Future

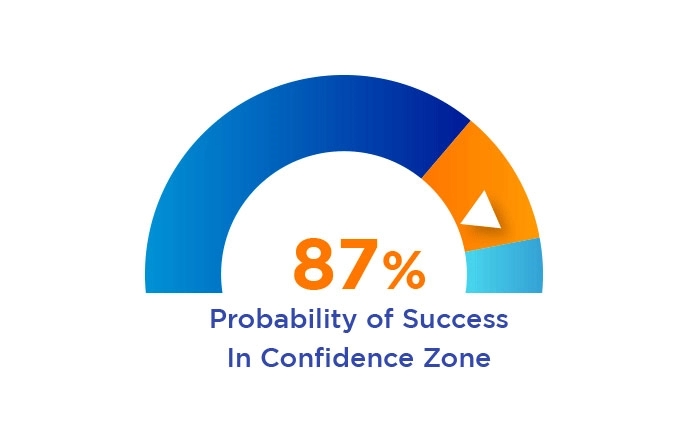

Create a personalized financial plan to prepare for life’s major moments. Answer life’s tough “what-if” questions in the Play Zone®. Explore insurance strategies to manage risk, evaluate retirement income and social security options.

Enjoy The View

Create a personalized financial plan to prepare for life’s major moments. Answer life’s tough “what-if” questions in the Play Zone®. Explore insurance strategies to manage risk, evaluate retirement income and social security options.

AIP Enrollment

Getting Started is Easy

1

Select the service package that best meets your needs.

2

Select the portfolio that best fits your investing style.

3

Answer a few questions to determine the portfolio allocation best suited for investment goals.

4

Open your accounts and begin funding your portfolio.

Begin Your Journey

Still have Questions?

Check out our Frequently Asked QuestionsRead FAQ

* Source: Data from Morningstar, Inc. Risk is based on the standard deviation of a hypothetical balanced asset allocation rebalanced annually, from 1970 to 2021. The moderate allocation is 35% large-cap stocks, 10% small-cap stocks, 15% international stocks, 35% bonds, and 5% cash investments. The indices representing each asset class are S&P 500® index (large-cap stocks), Russell 2000® index (small-cap stocks), MISCI EAFE® Net of Taxes (international stocks), Barclays U.S. Aggregate index (bonds), and ICE BofA U.S. 3-month Treasury Bills. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.